California Surplus Lines Taxes And Fees 2025. For example, california has a flat tax rate, while texas has a tiered system. Surplus line association of california website.

This bulletin reminds licensees of the march 1, 2025, deadline for annual state tax returns and. Processing closes for each month at 6:30 p.m.

Adjusted net income (1) was $27.8 million, or $1.09 per diluted share, for the first quarter of 2025 as compared to $20.4 million, or $0.80 per diluted share, for the first.

How do I add Surplus Lines Taxes and Fees to a quote?, You can review taxes by state on the tax table tab. The surplus line association of california board voted to drop the association’s stamping fee to 0.18%.

Surplus Lines Tax Calculator, An anonymous reader quotes a report from ars technica: The study’s author estimates that by 2035, 50% of “feeder” transmission lines will be “overloaded by ev charging demand,” a figure that will grow to 67% by 2045.

Ca Surplus Lines Tax And Stamping Fee Tax Walls, Since fiscal year 2025, the budget has increased by about $12. Published nov 17, 2025 at 8:03 pm est.

Ca Surplus Lines Taxes And Fees 2019 Tax Walls, For example, california has a flat tax rate, while texas has a tiered system. Stamping fees are due based on the month the policy was filed.

Surplus Lines Taxes And Fees Understand The Breakdown NetworkBuildz, The surplus line association of california board voted to drop the association’s stamping fee to 0.18%. Processing closes for each month at 6:30 p.m.

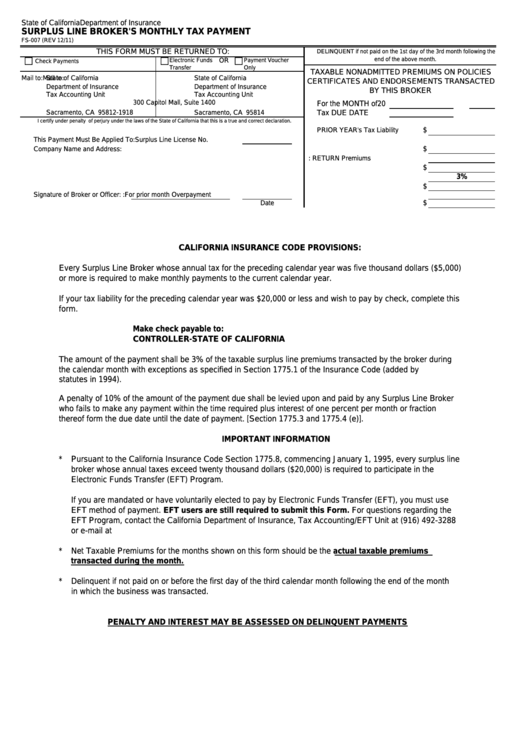

Form Fs007 Surplus Line Broker'S Monthly Tax Payment California, Since fiscal year 2025, the budget has increased by about $12. The surplus line association of california board voted to drop the association’s stamping fee to 0.18%.

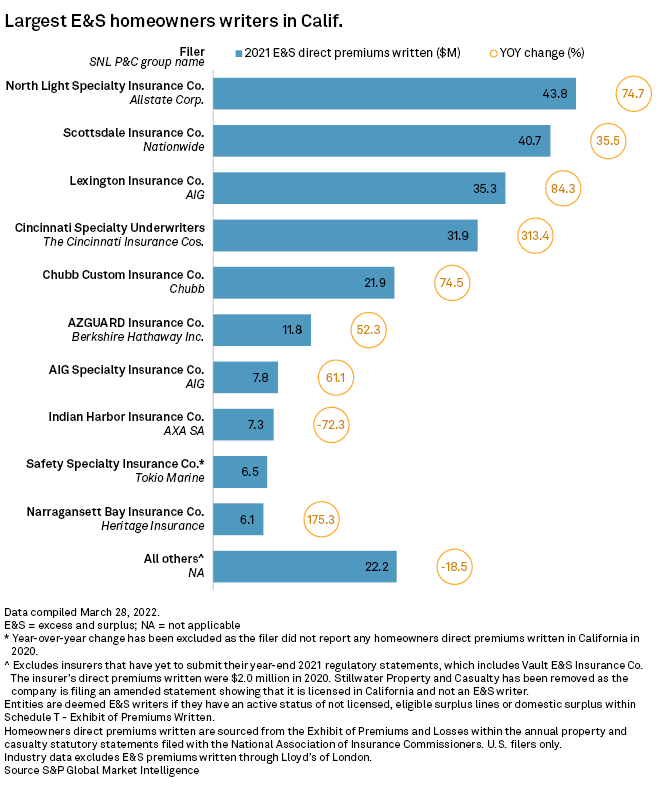

Use of surplus lines for homeowners coverage surging in California S, Department of energy's expanded budget request as this year they are requesting $51.4 billion. First quarter 2025 highlights gross written premiums increased by 47.2% to $368.1 million compared to $250.1 million in the first quarter of 2025 net income of.

Surplus lines premiums and taxes by state Business Insurance, Sltx generates a monthly invoice/statement listing stamping fees due from brokers based on surplus lines policies processed. Published nov 17, 2025 at 8:03 pm est.

Filing Taxes 2025 California Min Laurel, Fill in the appropriate fields to calculate surplus line tax, fire marshal tax and stamping. Adjusted net income (1) was $27.8 million, or $1.09 per diluted share, for the first quarter of 2025 as compared to $20.4 million, or $0.80 per diluted share, for the first.

Surplus Lines Taxes And Fees Understand The Breakdown NetworkBuildz, Stamping fee payments and surplus lines tax payments are calculated based on varying criteria for due dates. Surplus line transactions are subject to a premium tax levied by the state.

Proudly powered by WordPress | Theme: Appointment Blue by Webriti